Industry News, Agriculture & Feed

The 2016 CropLife 100 Report: Reviewing The Many Bulls And Bears Impacting This Year’s Marketplace

Industry News, Agriculture & Feed

Image: CropLife

For virtually all of 2016, the nation was wholly focused on the big Presidential election. Some folks aligned themselves with the Democratic Party and its symbol the donkey. Many others (at least based upon the election results themselves) found more kinship with the Republican Party, which uses an elephant as its animal symbol.

Within the agricultural marketplace itself, the nation’s ag retailers were more likely interested in other animal symbols when reflecting on their revenue fortunes for 2016. In this spirit, let’s take some time to look at how the overall ag retail marketplace performed using those two animal symbols commonly used in the financial sector, bulls and bears.

When looking at the entirety of the ag retail marketplace in 2016, things were definitely bearish. During the 2015 CropLife 100 survey, the nation’s top ag retailers enjoyed their best year ever with revenues topping $30.4 billion. This represented a healthy 1.7% increase over the $29.9 billion in sales the nation’s top ag retailers recorded on their books for the 2014 season. Given that this gain was accomplished despite falling commodity prices and reduced grower-customer incomes, many respondents in the 2015 survey wondered if the good financial news would continue once the numbers were totaled for the 2016 season.

And it didn’t. The combination of low commodity prices and grower-customer incomes apparently made their presences felt. According to the 2016 CropLife 100 ag retailer survey, overall crop inputs/services income for the nation’s top ag retailers came in at $29.6 billion for the year. This marked a steep 2.6% drop from the 2015 total and basically resets the total market value for ag retailers back to the level it was during the 2013 season.

When an overall marketplace crashes as the CropLife 100 did during 2016, the downward trend usually begins at the top and works its way down. This was certainly the case for this year’s financial report.

Since the beginning of the 2010s, the fertilizer category has annually led the way in revenues among ag retailers. In fact, for at least one year in 2012, sales for this sector alone topped the $15 billion mark, representing more than 55% market share compared with all other crop inputs/services.

But this hasn’t been the case the past few years. Starting in 2013, the fertilizer category began seeing its revenue figure and market share erode bit by bit. By the end of 2015, sales for this sector had fallen back to $14.6 billion with an overall market share of 48%. At this point, everyone was wondering if the category could possibly recover in 2016?

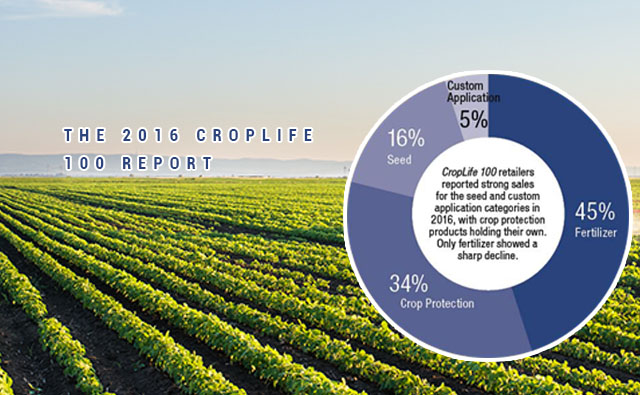

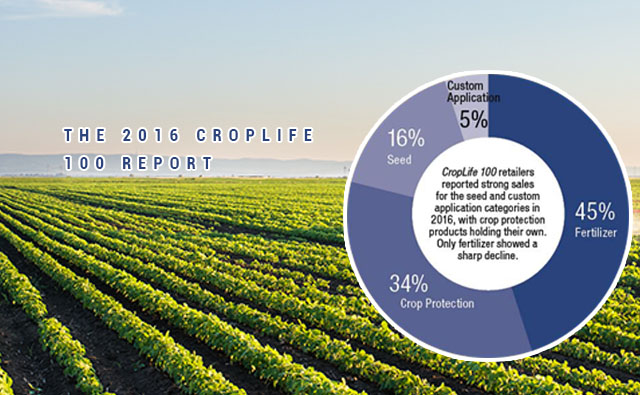

In a word, no. Bears continued to pound the fertilizer category for the year. According to 2016 CropLife 100 survey, revenues in this sector dropped just over $1 billion to end at slightly less than $13.5 billion. This represented a 7.4% decline from the 2015 total. Furthermore, market share for the fertilizer category now stands at 45% — virtually the same percentage it held almost one decade ago in 2006.

According to respondents, the fertilizer category continues to be plagued by an almost perfect storm of low commodity prices coupled with high macronutrient prices. Throw in some incredibly uneven weather events in various parts of the country the past two seasons and demand for fertilizer has remained “soft,” say most CropLife 100 ag retailers.

In sharp contrast to the fertilizer category, the seed sector was running with the bulls during 2016. This was something of a change in fortunes for the category. For much of the early 2000s, the seed category tended to be the fastest growing sector among all crop inputs/services for CropLife 100 ag retailers. Although it was working from a smaller base, the seed category typically grew between 4% and 10% annually through the early 2000s.

Then, starting in the 2010s, the seed category began a new pattern — up a few percentage points one year, down the next. This seemingly came to a head during the 2015 growing season, when plenty of seeds ended up being drowned in wet fields or unplanted because of the adverse weather. For that year, CropLife 100 ag retailers saw their seed category sales dip 4% to $4.3 billion.

But things were much better for the sector this year. The seed category enjoyed one of its strongest years ever in 2016, surging forward 6.9% to top $4.6 billion. With this uptick in overall revenues, the sector was able to improve upon its market share by 2%, now sitting at 16%.

Besides benefitting from improved weather conditions across much of the country in 2016, the seed category seems to be being driven by the host of new varieties and seed types now entering the marketplace. Other CropLife 100 survey respondents also noted that renewed interest by a handful of their grower-customers in traditional, higher value, non-biotech seeds was also a factor in the seed category’s improving financial performance.

For the third major component of the crop inputs part of ag retailers’ business, crop protection products, 2016 was a little bit bearish and bullish. On the bearish side, crop protection product category sales did decline during the 2016, but only ever so slightly — 0.4%, to be exact. When rounded for the purposes of this report, the sector came in for both 2015 and 2016 at just a hair over $10 billion. On the bullish side, however, since the basically flat performance outpaced other categories within the CropLife 100 rankings, the crop protection products sector did actually improve its market share position vs. other crop inputs/services for the year, advancing 1% to 34%.

According to most respondents, the continuing (and expanding) battle against herbicide-resistant weeds is largely driving crop protection products sales these days. With more than 70% of CropLife 100 ag retailers describing these biotypes as “a major problem in many of the fields we service,” the entire industry can probably expect overall crop protection products sales to remain in the $10 billion range for several years to come.

| Adjuvants Growing the Fastest | |||

| In 2016, six of the nine crop input/service segments tracked by the CropLife 100 survey recorded sales growth for more than half of the respondents. | |||

| Item | UP | FLAT | DOWN |

| Adjuvants | 65% | 24% | 11% |

| Crop Protection Products | 63% | 10% | 27% |

| Custom Application | 60% | 20% | 20% |

| Precision Ag | 60% | 34% | 6% |

| Seed Treatments | 57% | 28% | 15% |

| Micronutrients | 51% | 14% | 35% |

| Biotech Seed | 48% | 30% | 22% |

| Fertilizer | 41% | 1% | 58% |

| Traditional Seed | 37% | 48% | 15% |

| Base=93 Source: 2016 CropLife 100 Ag Retailers Survey |

|||

In tandem with the seed category, the other sector of the CropLife 100 that really enjoyed a bullish time during 2016 was the custom application category (which includes precision agricultural service/product sales as well). According to the survey, respondents saw their custom application revenues grow 2.4%, from just a hair under $1.5 billion in 2015 to just a hair over $1.5 billion in 2016. Market share for this category remained constant at 5%. As was the case with crop protection products, respondents credited the increased number of applications needed by many grower-customers to combat a new generation of herbicide-resistant weeds with keeping demand high for this sector.

When separated out from one another, custom application and precision ag showed similar growth curves. According to the 2016 CropLife 100 survey, respondents saw their custom application sales increase 2.5%, from just below $1.2 billion in 2015 to just over this amount in 2016. As for precision ag, sales in this sector improved 1.8%, from $305 million in 2015 to $311 million in 2016. Here, sales may improve even quicker in 2017 now that the Federal Aviation Administration will start to allow ag retailers to commercialize unmanned aerial vehicle (UAV) use in their operations. According to the survey, more than half of all respondents (51%) said their companies are planning to begin working in this area of the precision ag business once the 2017 begins.

Besides looking at just the crop inputs/services sides of the business, the annual CropLife 100 report also tracks how many consolidations and mergers took place among its members from one year to the next. For many years during the early part of the decade — as commodity prices for corn and soybeans were at near record highs — the incentive to sell a long-established ag retail business wasn’t as evident.

During the past two years, however, commodity prices have fallen back down to Earth. As a result, several ag retailers that might have been considering exiting the marketplace before the boom times of 2010-13 started doing so again once the 2014 season came to a close. This is why entities such as Golden Furrow Fertilizer, Eldon, IA, and MRM Ag Service, East Prairie, MO, disappeared from the landscape during 2015. The trend continued in 2016, when Cargill AgHorizons was acquired by Crop Production Services.

But by far the more common trend in 2016 was for ag retail consolidation to take place at the cooperative level. Earlier in the year, CropLife 100 member Farmers Elevator Association formally merged with two other retailers to form Cooperative Farmers Elevator. Also, Watonwan Farm Service combined with Central Valley Cooperative to form Central Farm Service. Farmers Cooperative and West Central Cooperative, both based in Iowa, combined their resources to create Landus Cooperative. And other current members of the CropLife 100 are considering their own company get-togethers, including Heritage Cooperative, which would take place during 2017.

Speaking of the 2017 season, which animal symbol might rule the day doesn’t seem to be much a debate with CropLife 100 ag retailers at this point. When asked in the survey what their outlook was for 2017, absolutely no one described their mood towards the year as “very optimistic.” Twenty-two percent did view their financial prospects for 2017 as “cautiously optimistic.” There are not too many bulls on the horizon, says this group.

Instead, the bears are expected to show up. According to the 2016 CropLife 100 survey, 55% of respondents are “somewhat pessimistic” for their profits staying in positive territory during 2017. Another 23% described their outlook for 2017 as “very pessimistic.”