Industry News, Agriculture & Feed

Supply Chain Disruptions Temper Agchem Recovery, But Optimism Prevails

Industry News, Agriculture & Feed

Agrochemical companies experienced strong sales in 2021, but they are looking for a more vigorous recovery in 2022 in the face of pervasive supply chain troubles, according to the 2021 AgriBusiness Global State of the Industry Survey.

About 31% of respondents to the survey expect full-year revenue to be at least 11% higher than last year, while 27% say revenue will be between 6% and 10% higher than a year ago. About 19% say revenue will be 1% to 5% higher; 14% say revenue will be about flat (Chart 1).

Most companies ramped up production during the year, with 79% saying they expected output to climb in 2021 and another 14% expecting flat volumes (Chart 2).

For 2022, companies expect to fare even better: 37% anticipate revenue gains between 6% and 10%, while another 27% project at least an 11% increase. Just 7% of respondents expect revenues to drop (Chart 3).

Click to read the full charts on Agribusinessglobal.com

Fourth-quarter orders are subject to the very real specter of a global shortage of supply as China’s “dual controls” on energy consumption policies start to have meaningful impact on output, according to Bob Fairclough, Principal Consultant for UK market research firm Kynetec.

“The substantial manufacturing bases within the provinces of Jiangsu and Yunnan for instance — both being situated in the red zone — are likely to see an ever-increasing restriction on energy provisions into Q4. Already in Yunnan, yellow phosphorus production in September reportedly has been reduced by 90%. This tightness of supply will feed through to the remainder of 2021 and into early 2022.”

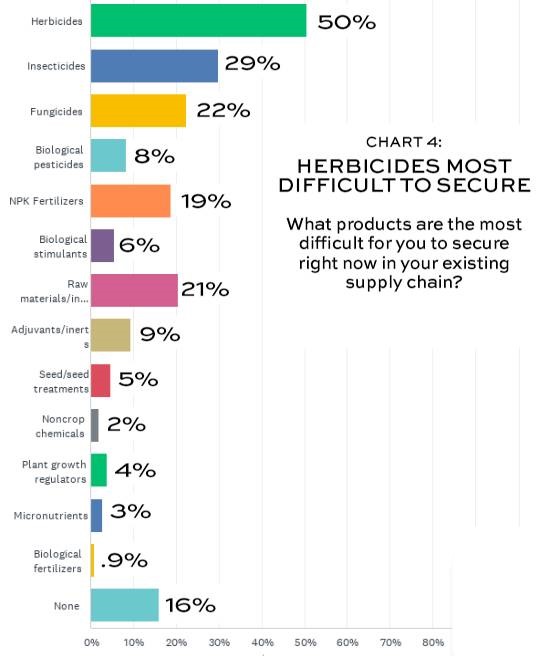

Half of respondents to the 2021 AgriBusiness Global State of the Industry Survey say they are having the most difficulty securing herbicides, followed by insecticides (30%), fungicides (22%), raw materials/intermediates (21%), and NPK fertilizers (19%) (Chart 4).

It comes as no shock that supply chain woes are markedly impacting contracts and purchasing terms. A full three-quarters of respondents say they have made or are exploring changes to their company’s supply chain to mitigate risk since the pandemic and other supply disruptions. About 53% of respondents say that companies will be buying on longer lead times, while 40% say smaller orders will be more difficult to fulfill, and 35% say companies will be more opportunistic to ensure supply. Another 32% say payment terms will be shorter, and 30% say credit will be less available.

It comes as no shock that supply chain woes are markedly impacting contracts and purchasing terms. A full three-quarters of respondents say they have made or are exploring changes to their company’s supply chain to mitigate risk since the pandemic and other supply disruptions. About 53% of respondents say that companies will be buying on longer lead times, while 40% say smaller orders will be more difficult to fulfill, and 35% say companies will be more opportunistic to ensure supply. Another 32% say payment terms will be shorter, and 30% say credit will be less available.

Moreover, COVID-19 has affected the availability of labor for nearly 40% of respondents’ operations. In response to labor struggles or new operating requirements, about 44% are investing more in automation at their facility, while another 17% have not yet but are considering doing so (Chart 5).

According to many industry sources with whom we talked, the supply chain situation can be traced back to a series of compounding issues rather than to the pandemic alone. The Trump Tariffs of 2018 first slowed imports from China into the U.S., after which distributors and retailers began working down the pile, reducing inventory levels by about half over the past three years, according to Brett Bruggeman, President of WinField United.

COVID hit, “then wham — in 2021, 180 million acres were planted, short of forecast. We had shorter planting windows, and it just put a crunch on the supply chain. We would say we were fortunate because we started taking in product early and delivering. We don’t see this changing for 2022,” he says.

In late August, Hurricane Ida hit Bayer’s main glyphosate plant in Luling, Louisiana, and shuttered it for five weeks, pouring salt over the wound.

According to a well-placed, anonymous source, Bayer simply does not have enough capacity to make 160 million gallons of glyphosate needed to fill the gap for the U.S. season between now and July 1, 2022. Just 20 million gallons of glyphosate have been imported since August, so a fair amount of Chinese material is required to make up the difference, the source said. At the same time, power cuts loom in China in January and February, immediately followed by slowdowns due to the Chinese New Year in early February and overlapped by the Beijing Winter Olympics Feb. 4-20.

Drake Copeland, Technical Service Manager at FMC, says his company is well positioned to meet demand — but then comes the tricky part. If other major manufacturers are struggling, it will impact everyone at some point.

“It’s not just a BASF problem or a Bayer problem — if they don’t have the supply they’re going to look elsewhere,” Copeland says. “We feel good about our situation, but we get business we haven’t had in the past because of it and not be able to supply the market. It’s the unknown.”

Sentiments about the global economy improved greatly over 2020: 67% of respondents say the global economy will improve, a reversal of last year, when 71% of respondents said the global economy will get worse, and almost a quarter expected it to be much worse (Chart 6).

Click to read the full charts on Agribusinessglobal.com

Domestic sentiment also flip-flopped from a year ago, with 66% of respondents saying their local economies will improve in 2021. Thirty-four percent, however, believe their local economies will worsen to varying degrees.

Competition continues to outrank other factors on the survey posing the biggest challenge to increasing sales, with just over half of respondents placing it at the top of their list. Access to markets followed, with retailer/farmer education ranking as the third-largest challenge. Lack of marketing/awareness, lack of automation, and lack of customer service trailed, in that order. Import/export companies were rated as the biggest source of competition at 42%, with multinational companies following closely behind at 33%.

Uncertainty continues in 2021, and companies have held off on consolidation plans accordingly, although the picture is slightly improved from a year ago. About 70% of respondents say they won’t look to make any acquisitions in 2022, compared with 75% a year ago. About 14% say it is a strong possibility or certainty that they will acquire all or part of another company, up from 10% in 2021 (Chart 7).

New product development is robust (Chart 8): 64% of respondents plan to develop new product lines this year, on par with the 60% who said they would do the same in 2021. Of the companies who are developing new product lines, herbicides, insecticides, and fungicides ranked equally with 49% of companies exploring development plans for each, followed by biological pesticides (30%), biological stimulants (29%), and plant growth regulators (17%).

A whopping 87% of respondents say they are seeing an increase in demand for biological products, and 82% say they either already have some biological products in their portfolio or are actively looking (Chart 9). Biological products are the fastest-growing crop input segment, and 65% of respondents attribute this to consumer demand for safer foods, a trend that continues to influence crop production models like never before.

AgriBusiness Global’s™ annual State of the Industry Survey and special report offers readers a biographical snapshot of the health of the industry and the sentiment of the companies that operate in it. The survey was designed by AgriBusiness Global editors and broadcast to our email subscriber base. Email reminders were sent during the four weeks the survey was open Nov. 17-Dec. 8, and an incentive was offered to win a $100 gift card. The survey was taken by 144 respondents in 40 countries, giving the survey a margin of error of ±8.1% with a 95% confidence level.

Click to read the full charts on Agribusinessglobal.com

The survey respondents represent primarily crop protection manufacturers and formulators (46%), distributors and trading companies (38%), and plant health suppliers and distributors (26%). About 35% do not originate any molecules, and 32% do not formulate any products, indicating that trading companies and non-formulating distributors still represent a significant share of the industry.

About half of responding companies (51%) had gross revenues of less than $25 million in 2021, which is consistent with the past 10 years. However, the number of companies that gross more than $250 million (23%) has doubled since 2009 (first year of the survey), illustrating consolidation among the largest companies in the industry.

The number or registrations per company has remained consistent in the past 10 years: 46% of respondents this year hold fewer than 10 registrations, and 12% of companies held at least 50 product registrations last year compared to 8% in 2009. The number of companies with zero product registrations rose from 15% in 2010 to 25% this year. This data illustrates consolidation among larger companies and also the difficulty of more stringent and expensive regulatory environments, forcing a share of companies to abandon product registration strategies to focus on pure import/export and distribution business.

For 36% of respondents, their respective markets represent at least 75% of their business; 29% of respondents rely on export markets for at least 75% of their businesses.