Industry News, Adhesives & Sealants & Tackifiers

Adhesive and Sealant Market Overview and Outlook

Industry News, Adhesives & Sealants & Tackifiers

The ChemQuest Group estimates the global adhesive and sealant industry to be approximately $53 billion at the end of 2015, comprised of $46.3 million in adhesives and $6.5 billion in sealants. This figure represents an increase of 3.5% in 2015. The adhesives market is approximately seven times larger than sealants in terms of value.

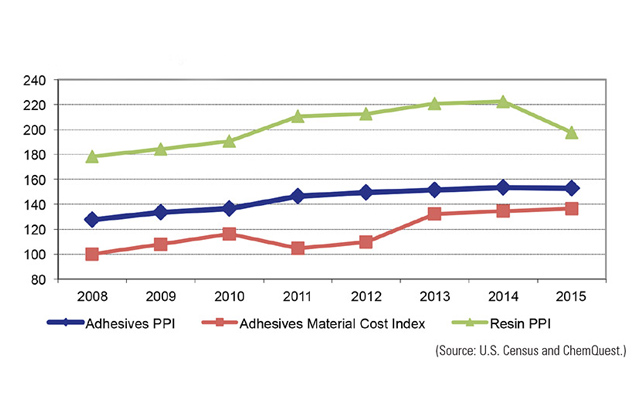

Figure 1. Adhesives and sealants sales by region. © ASI

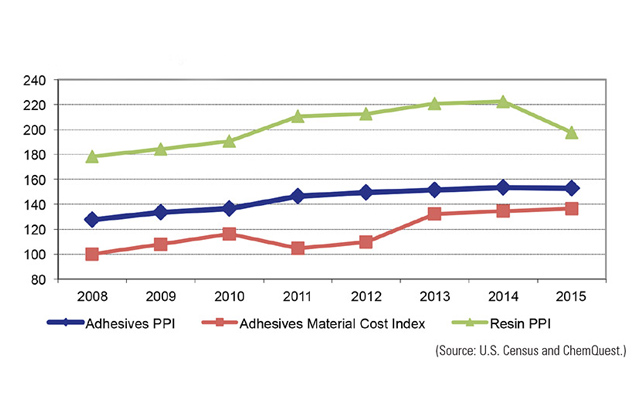

Breaking sales out by region, North America, Europe, and Asia each make up are about equal in size, with the remainder (10%) split between South America and the Middle East/Africa (see Figure 1). In North America, sealants were 1.14 billion lbs, while adhesives were 7 billion lbs for 2015. In terms of revenue, the adhesive industry is nearly $16 billion and the sealant industry is about $2.4 billion. Gross domestic product for the U.S. was 2.4% in 2015, flat with 2014 and for the sixth year in a row under 3%. In line with the lower overall economic growth, we expect the industry overall to grow about 1.5-2.5% in volume (at or slightly higher than GDP) with an additional half a percent in pricing for overall growth of 2-3% in terms of value. Sealants are expected once again to outpace adhesives because of their position in construction and transportation (which make up 95% of sealant demand).

Figure 2. Adhesives and sealants value (left) and volume (right). © ASI

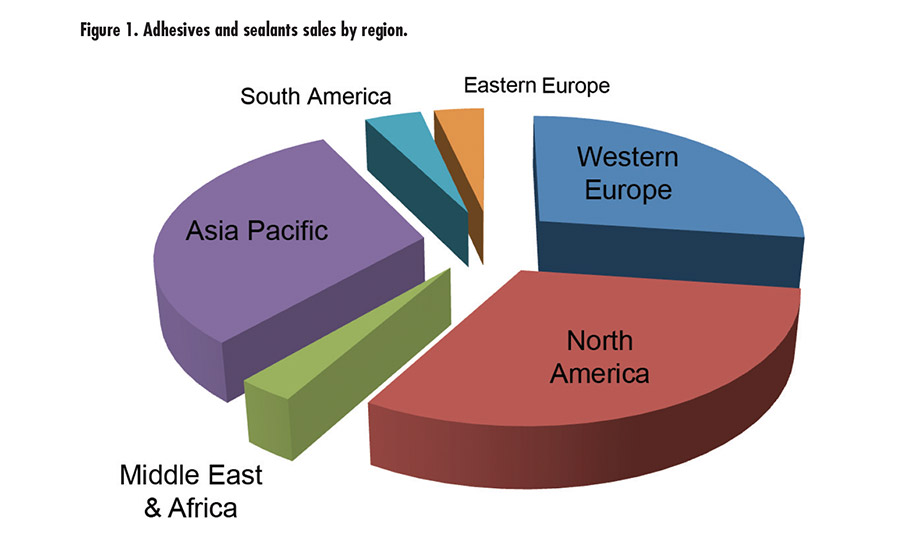

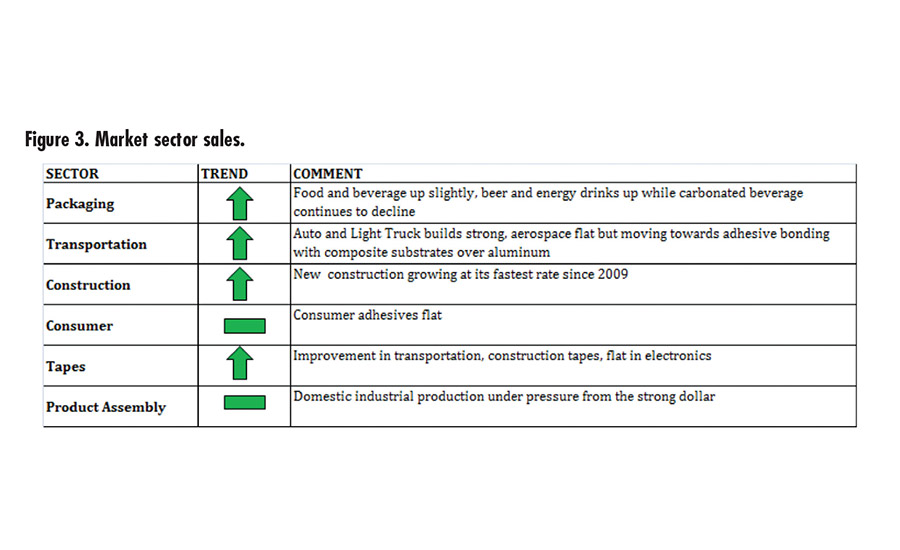

Among the individual market segments in North America in 2015, packaging was up slightly, consumer and product assembly were relatively flat, and transportation and construction were strong. The two sectors that really shined were transportation and construction. Auto and light truck sales were up 8.5% to 17.4 million units in 2015, marking the sixth consecutive year of sales increases. Total new construction was up 10.6% in 2015, with new single-family homes up nearly 15% from the previous year. The outlook for 2016 continues to be favorable; we expect to see growth (although muted) in all sectors.

Figure 3. Market sector sales. © ASI

Looking at the macro demand drivers for adhesives and sealants, the industry faces generally positive fundamentals across the markets where they find use. Improved construction standards enhance sector penetration, with significant interest from civil engineering applications for infrastructure repair. The 2025 Corporate Average Fuel Economy (CAFE) standards for autos is bringing more composites and plastics to save weight, which also results in the need for more non-mechanical adhesive bonding applications between dissimilar substrates.

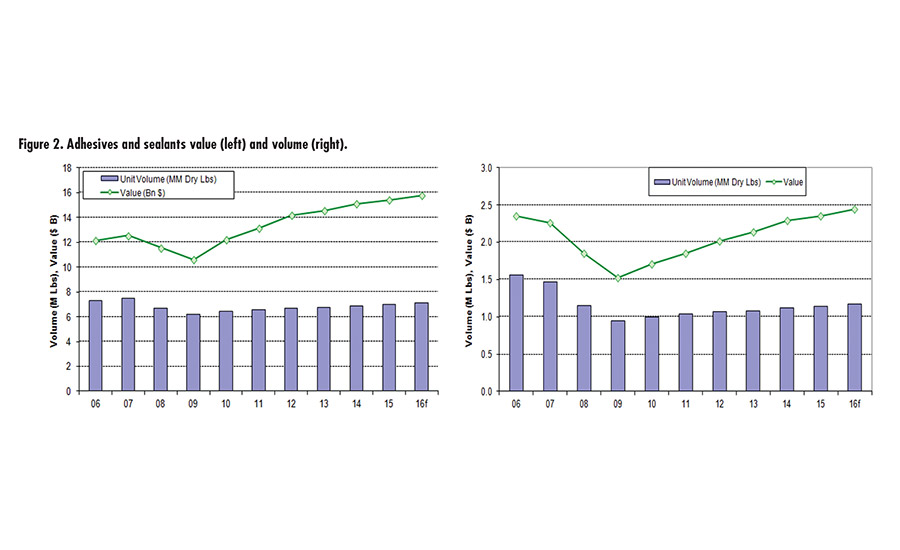

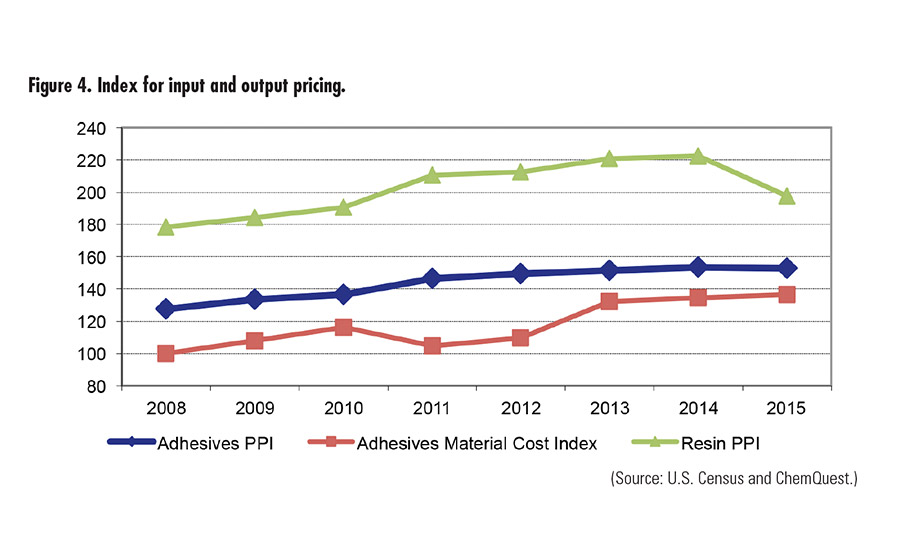

Figure 4. Index for input and output pricing. © ASI

Finally, while price increases for 2015 were muted, margin expansion for adhesive formulators was favorably impacted by lower raw material costs as oil fell dramatically (see Figure 4). Although oil has recovered recently, it’s unlikely to return to its highs of over $100 a barrel anytime soon, which bodes well for manufactures of formulated adhesives.